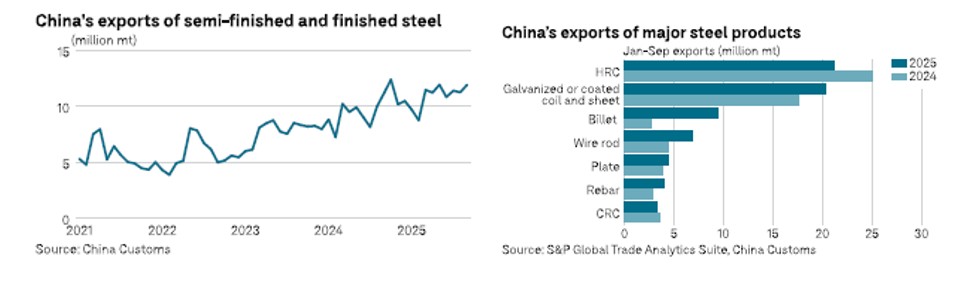

China’s exports of semi-finished and finished steel in September reached their highest level in 2025, recording the second-highest monthly volume ever, according to the latest

customs data.

Market participants based in China said Oct. 23 that they expect steel exports to slow from the fourth quarter amid rising global trade barriers. However, weak domestic demand for construction steel may continue to support exports of related steel products.

China’s semi-finished steel exports were 1.494 million metric tons in September, down 15.3% from August but up 41.9% from a year earlier, customs data showed Oct. 22. From January to September, exports of semi-finished steel jumped 224.1%, or by 7.423 million mt, to reach 10.736 million mt.

Total exports of semi-finished and finished steel were 11.959 million mt in September, up 1.1% from August and 6.7% from a year earlier.

From January to September, exports of semi-finished and finished steel increased by 17.7%, or 14.825 million mt, to reach 98.691 million mt.

During the first nine months of 2025, imports of semi-finished and finished steel fell 24.3% to 5.158 million mt.

China’s net exports of semi-finished and finished steel were 93.532 million mt over January-September, up 21.4% from a year earlier.

Several China-based trading sources anticipate that China’s steel exports could fall in October due to poor order bookings received in August amid higher Chinese steel prices.

However, overseas orders have improved since late September, which could support steel exports at relatively higher levels in November-December, the sources said.

“I think steel exports could remain strong in November-December, also because the EU is likely to reduce its steel import quotas and increase import tariffs on volumes exceeding these quotas from early 2026,” said a trading source. “So, European buyers are likely to accelerate purchases before this happens.”

Meanwhile, Chinese domestic steel demand has remained subdued, which is expected to keep steel prices low in the fourth quarter and support the competitiveness of Chinese exports.

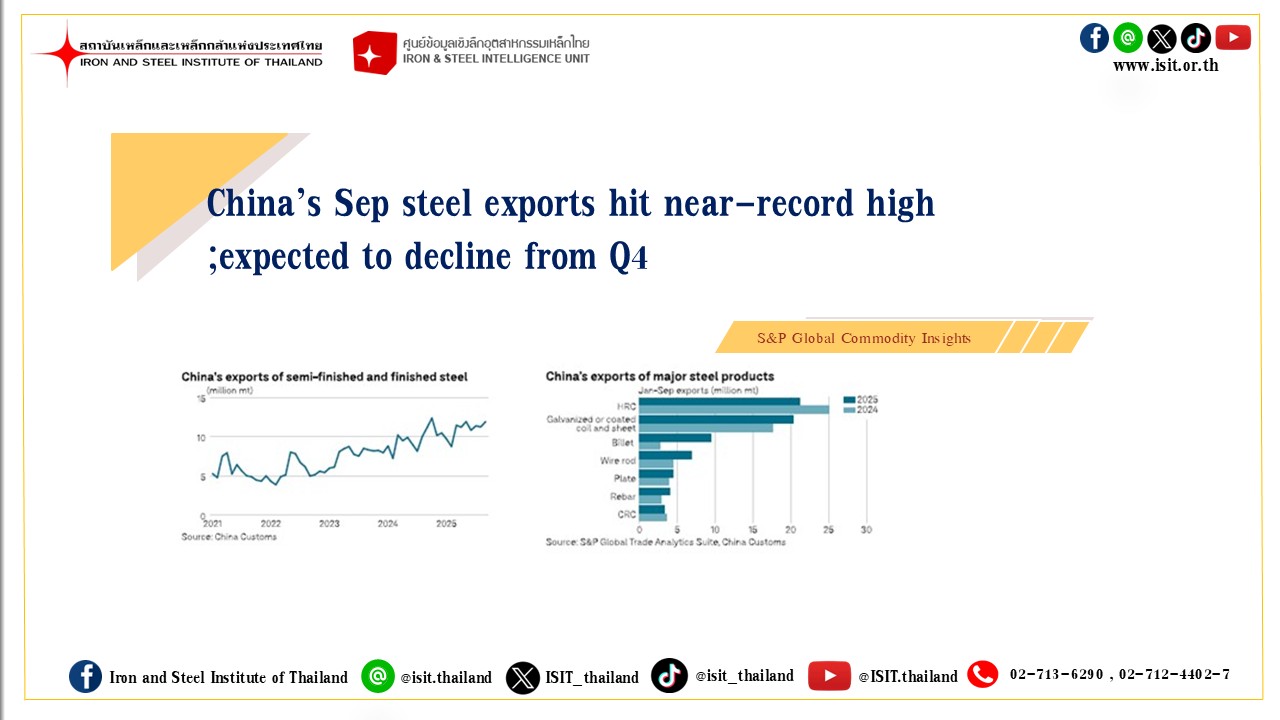

“China’s construction steel demand has remained on a downward trend so far this year, and I think the downtrend will continue into 2026,” another trader said. “Therefore, exports of long steel products, including billet, are likely to remain [supported].”

The trader expects competition in the international steel market to intensify in 2026 due to trade barriers, potentially leading to a decline in China’s steel exports.

“If the EU reduces steel import quotas in 2026, it could trigger a chain reaction,” said a third trader. “Chinese steel’s global competitors will have to compete more fiercely in other destinations, and countries importing Chinese steel and processing it for reexport to the EU may also increase trade barriers to reduce imports of Chinese steel.”